Guide to Risk Management of Cladding

Identifying, Reporting & Managing Cladding Risks

Strata Community Insurance is committed to providing our customers with market-leading products and practical solutions that assist in managing the complex risks and exposures facing our industry.

The following is a tool to support owners, strata managers and insurance brokers with the identification, reporting and risk management of buildings where Aluminium Composite Panel (ACP) type materials are present.

Strata Community Insurance is committed to providing expert support and assistance based on all information as and when it becomes available.

Background

The building industry is constantly under pressure to contain and reduce escalating building costs while improving building standards and increase profit margins. To keep up with these demands, Australia has looked for new and innovative building development solutions such as the import of prefabricated building and infrastructure components from Asia.

Some of these innovations are suboptimal and have been found to have serious flaws, putting Australian lives at risk.

The building industry is facing another crisis with the use of sandwich panels (panels of various thicknesses, of at least three layers including inner and outer skins and a central core) which were introduced in the 1980s.

ACP became a popular material for medium and highrise buildings across Australia. It revolutionised the building sector by providing a low-cost, insulated and aesthetically pleasing skin or layer that was easy to attach to a building’s framework.

However, highly-flammable ACP cladding has led to major fire damage – as evidenced in cases of the Lacrosse building in Melbourne (2014) and the Torch Tower in Dubai (2017) – and even loss of life as in the Grenfell Tower fire in London (2017).

The National Construction Code (NCC) and its predecessor the Australian Building Code forbids the use of any external cladding which does not prohibit the spread of fire. However, the interpretation of the code and subsequent fires has resulted in the Australian Government setting up an inquiry into the potential exposures for buildings who are using noncompliant and/or non-conforming building products.

The Insurance Council of Australia (ICA), together with BRE Global (a world leading multi-disciplinary building science centre in the UK), have released a categorisation system for ACP. BRE has run seven façade tests and have categorised three different ACP insulations, based on these criteria (ref: www.gov.uk/ guidance/building-safety-programme).

In line with the ICA’s guidelines published in November 2017, Strata Community Insurance suggests that all bodies corporate must be aware of the composition and suitability of materials used in the construction of their building.

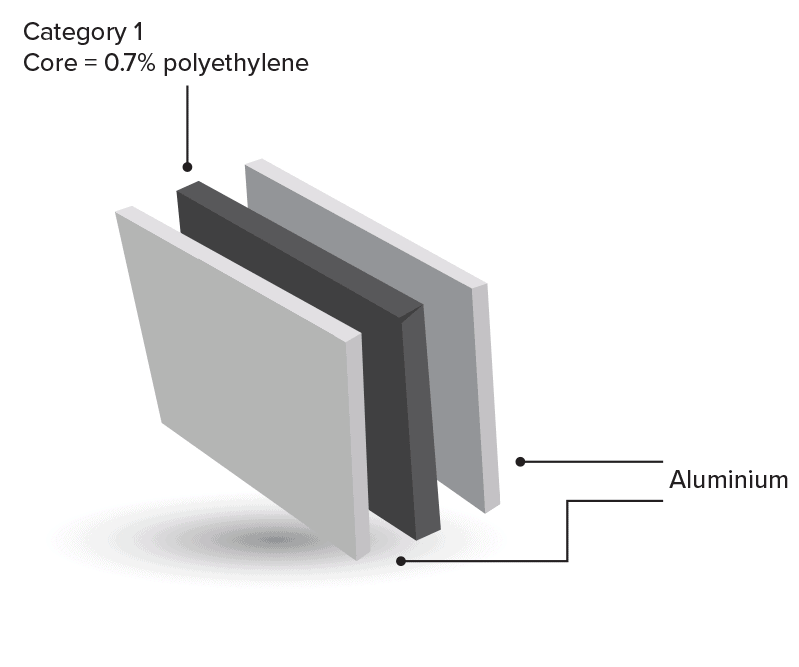

Category 1

BETWEEN 0% AND 7% POLYETHYLENE

Typically, an aluminium honeycomb or similar core or up to 7% polyethylene with 93% inert materials – considered close to non-combustible. Strata Community Insurance offers full insurance cover for these materials in line with the standard policy terms and conditions.

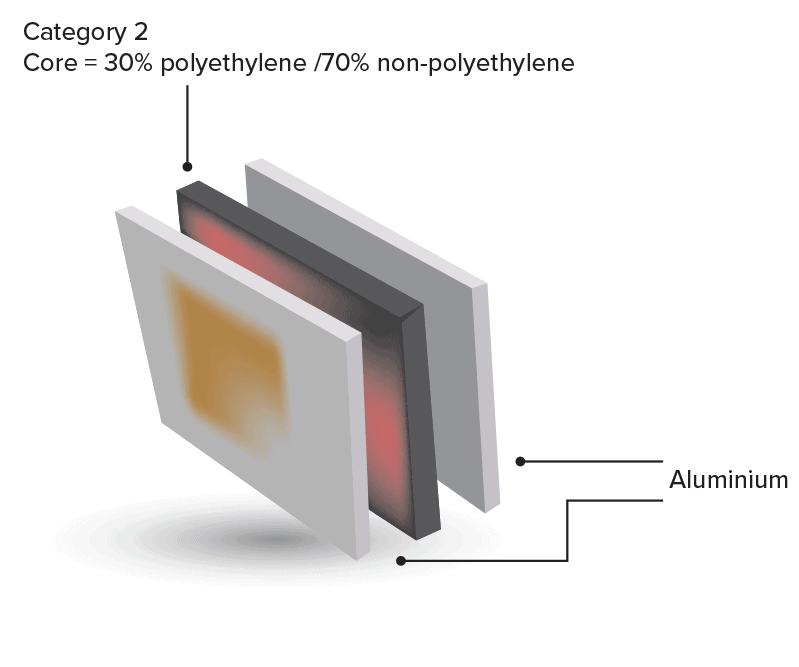

Category 2

UP TO A MIX OF 30% POLYETHYLENE WITH 70% INERT MATERIALS

Typically, these products would not pass either Australian Standards AS1530.1-1994 or AS5113:2016. The installation of these materials will require special fittings, backing materials and other installation methods that allow the material to reach a ‘deemed to satisfy’ status under the NCC.

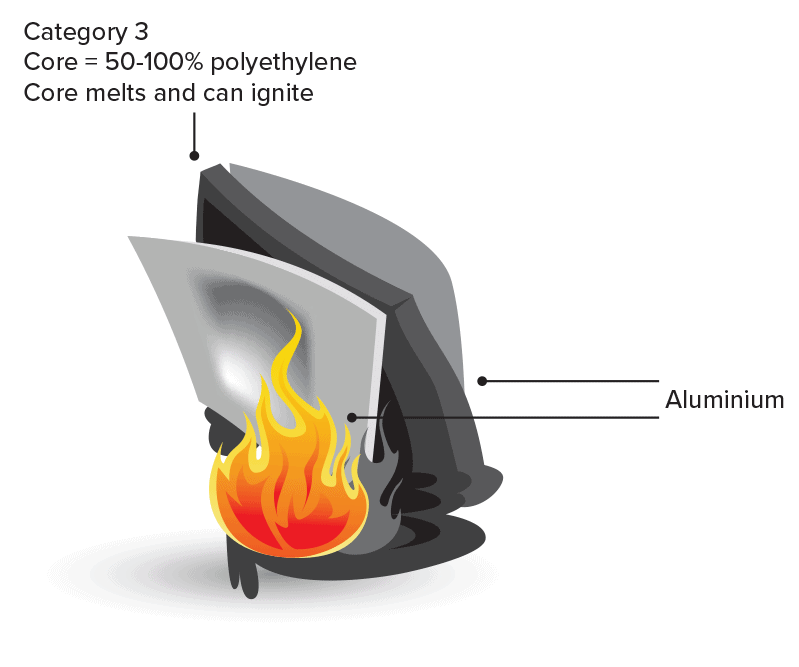

Category 3

BETWEEN 50%-100% POLYETHYLENE

These are considered problem materials. They should not exist on high rise and have restricted use on low rise buildings.

The following three step process is recommended:

STEP 1 – Identify the cladding

This could be as simple as a visual inspection, identifying material via plans and other documents issued when the building was certified or may require material testing.

Strata Community Insurance recommends the appointment of properly trained professionals such as fire engineers or a competent fire safety practitioner to provide recommendations. Body Corporates’ (ie bodies corporate/owners’ corporations etc) should note that all jurisdictions have now started registers for suitably qualified people (e.g. NSW Department of Fair Trading can be contacted for assistance).

The body corporate should ask companies to supply detailed quotes as pricing can vary considerably ranging from $500 to $20,000 or more.

Once identified, Strata Community Insurance can assist with the insurance process and with any further questions the body corporate may have.

When ACP is identified as Category 1, Strata Community Insurance will require the appointed professional’s written notification/certificate and full policy cover will be applied subject to normal policy terms and conditions.

STEP 2 – Evaluate the exposure

When an ACP has been identified as either Category 2 or 3, then the body corporate should consider:

What exposures exist to the safety of the occupants based on Step 1 outcomes?

What are the exposures to the property and consequential losses that may further result after a fire involving the ACP?

What exposures exist to the reputation, image and market value of the building because of the ACP identified?

Is the building compliant, or can the building be made to be ACP-compliant as per the NCC and associated Australian Standards?

STEP 3 – Take remedial action

A fully-trained professional/fire engineer can assist with the questions in Step 2. Once the ACP has been declared compliant with the NCC and associated Australian Standards, we may consider the ACP to be equal to ‘Category 1’ material. Therefore, when ACP is identified as Category 2 – together with any work required for compliance purposes – Strata Community Insurance requires the appointed professional’s written notification/certificate and full policy cover will be applied subject to normal policy terms and conditions.

Making a building compliant

The body corporate needs to consider what to do if the ACP cannot be made compliant in terms of the NCC and associated Australian Standards i.e. material identified as Category 3.

Strata Community Insurance can offer limited cover for purposes of the body corporate’s duty to insure. For example, the cover offered may have:

a. increased excesses, or

b. premium increases or

c. a combination of both.

In these instances, for the body corporate to return their insurance to ‘normal’ status, Strata Community Insurance would recommend replacement of the cladding.

Strata Community Insurance is committed to driving educational excellence within the strata sector. In addition to bringing truly authentic and valued strata insurance products to the industry, key to our offering is sharing the strength of our experience and knowledge to offer support to our business partners.

References to policy terms and conditions are by way of summary only. For full details of policy terms, conditions, benefits and exclusions please refer to the relevant Product Disclosure Statement and Policy Wording, available from Strata Community Insurance.

For more information or support, please contact your local Strata Community Insurance expert.

This page’s content was last updated on 1 August 2023.

Download Resources

Download the “Guide to Risk Management of Cladding” PDF below.

Stay ahead with our strata insurance updates!